First Class Info About How To Buy A Mortgage Note

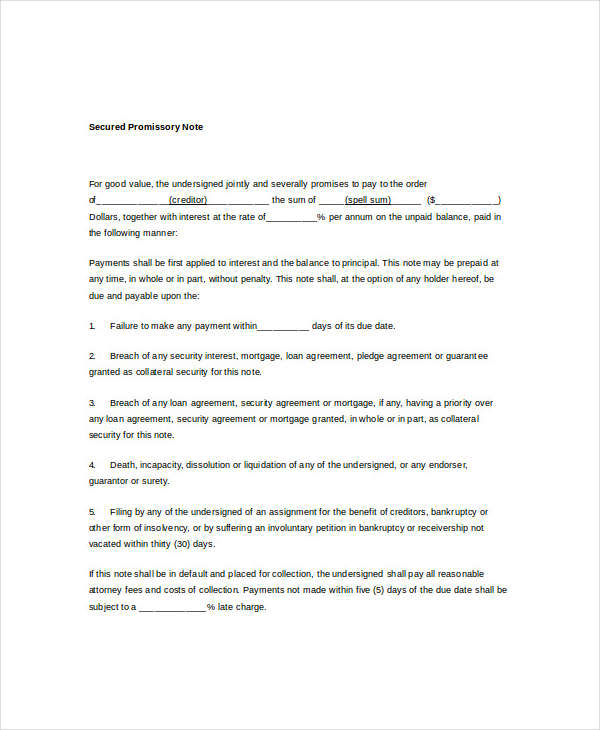

This is why many investors go through brokers to find mortgage notes for sale.

How to buy a mortgage note. These brokers specialize in locating both private and public deals. Sell a specific dollar amount, so you receive a lump sum of cash now and later will not receive. Our online closing is simply the fastest, easiest and dare we say funnest way to buy and sell mortgage notes.

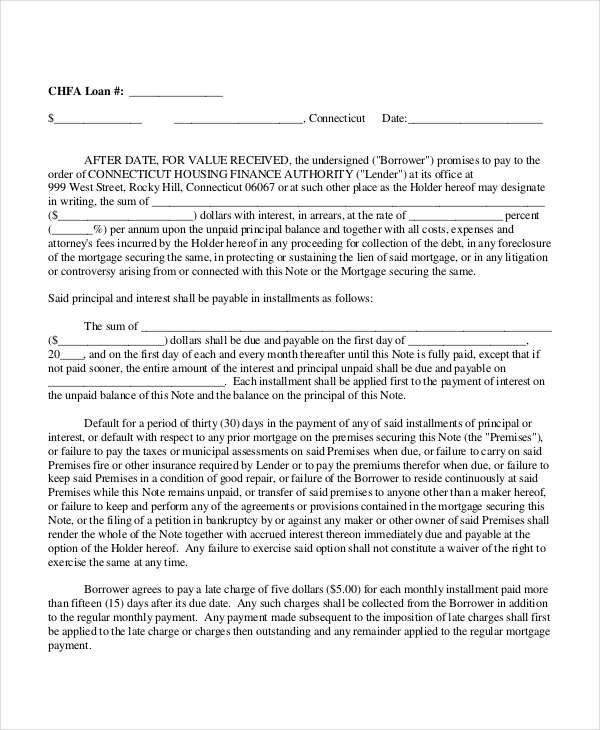

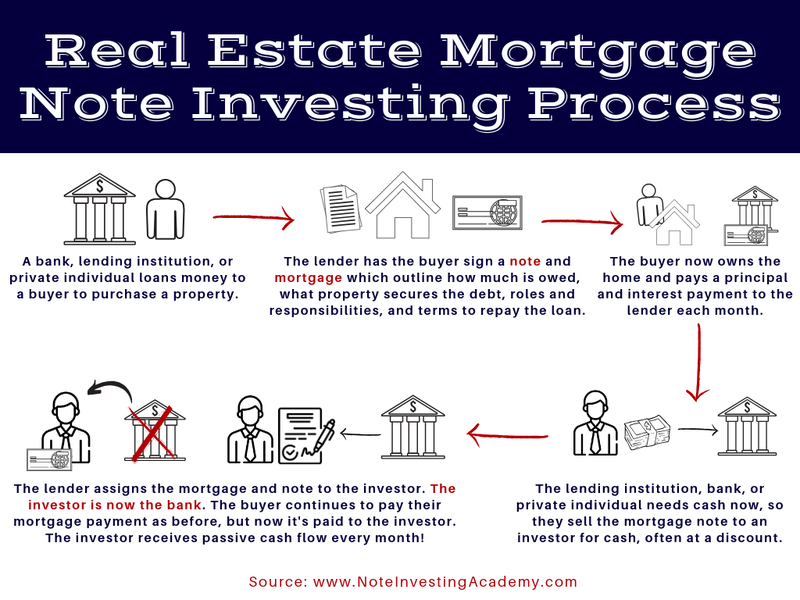

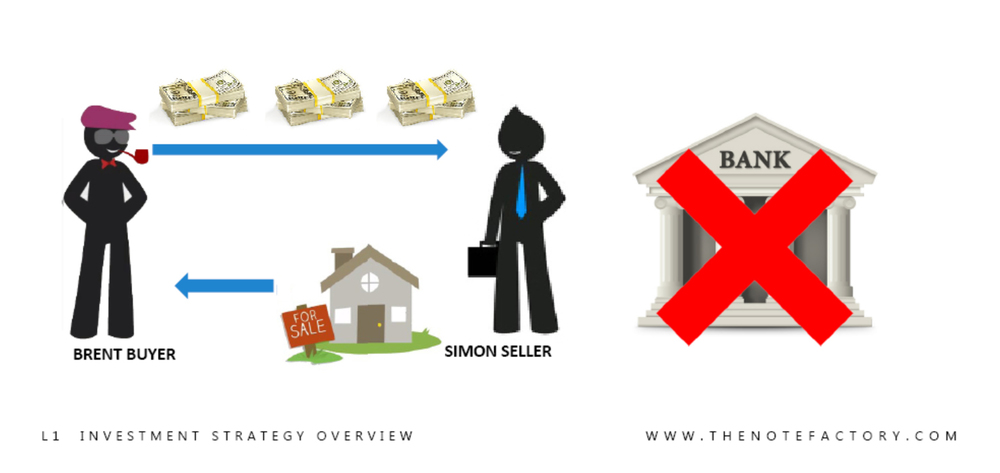

Close your deals without leaving your computer! Real estate investment trusts (reits) may sell shares of mortgage notes, and that. Mortgage notes document the terms of the mortgage, which means they are determined by the type of loan the borrower is taking out.

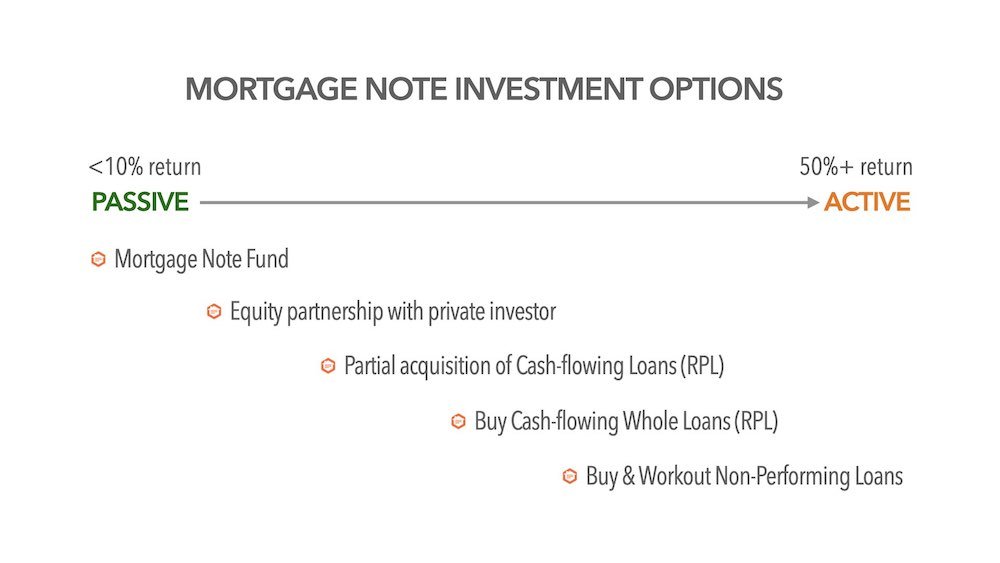

They usually have a reserve ratio amount, which limits how much they can have in reserve for lending purposes. The first step to buying a single mortgage note or portfolio of assets is to define your investment objectives, risk tolerance & source/amount of capital to deploy. The leading sellers of mortgage notes are banks.

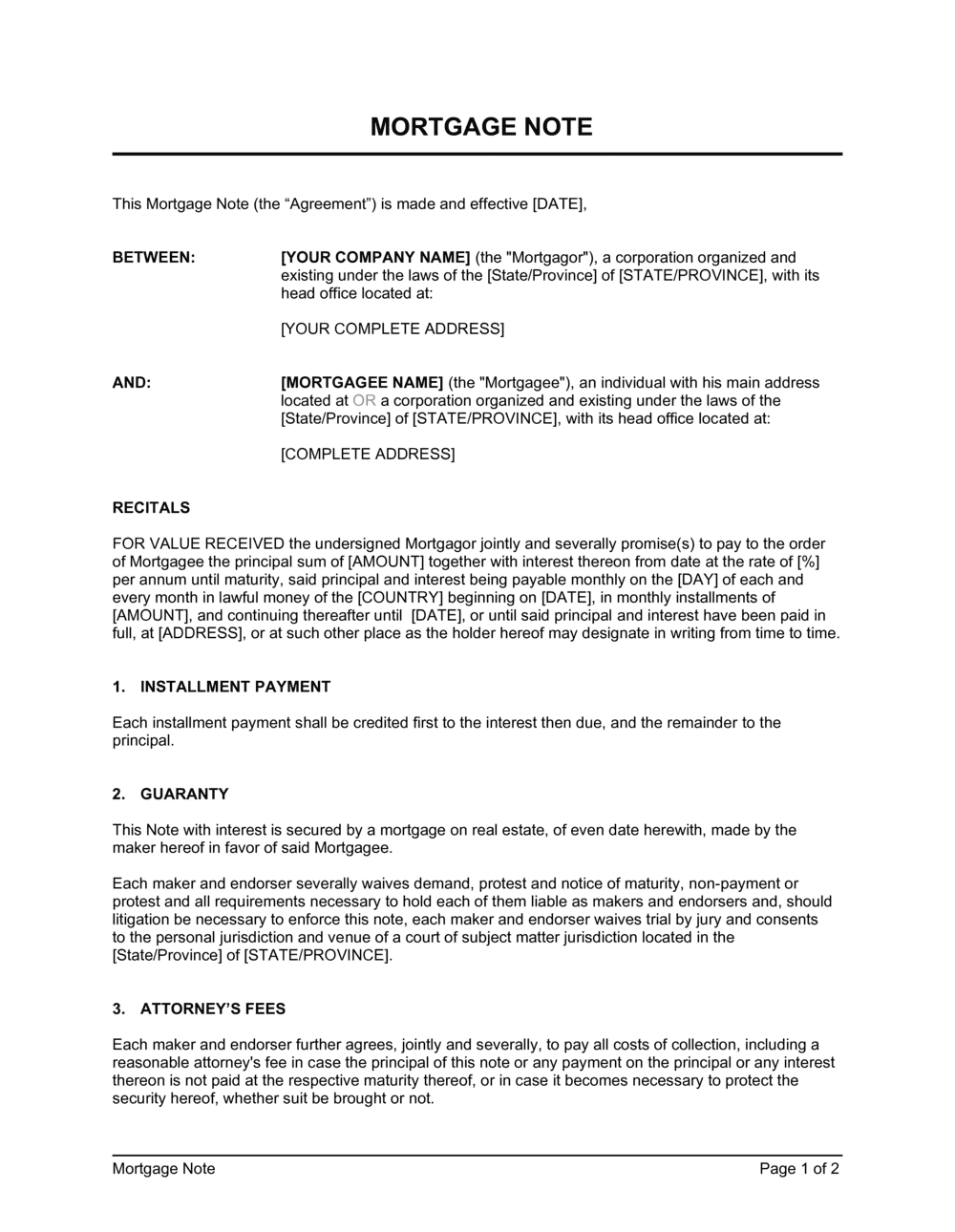

As the loan types differ from each other, so do the. The “present value” or current balance owed on the note would be $96,574.32. The mortgage allows the lender to take possession of the real.

How to get a mortgage note request loan paperwork from your lender. To obtain a mortgage note, you need to apply for a loan with your lender. If you wanted to earn 12% on your investment you would pay $83,322.39 for the note.

A real estate note, also called a mortgage note, is a promissory note associated with a mortgage or deed in trust. Sell your entire mortgage note, so you stop receiving mortgage payments and get cash now.

![How To Buy Mortgage Notes In 2022 [5 Steps] · Distressed Pro](https://www.distressedpro.com/wp-content/uploads/2016/11/how-to-buy-notes-480x270.jpg)

![How To Buy Mortgage Notes From Banks [2022 Guide] · Distressed Pro](https://www.distressedpro.com/wp-content/uploads/2016/11/how-to-buy-notes-from-banks-480x270.png)

![How To Buy Mortgage Notes In 2022 [5 Steps] · Distressed Pro](https://www.distressedpro.com/wp-content/uploads/2016/11/loan-criteria.png)