Outrageous Info About How To Avoid Credit Card Payments

Prioritizing your payments can help you avoid credit card debt.

How to avoid credit card payments. Set up alerts in your credit card account or connect your cards to a budgeting app to look for suspicious charges. Monitor your credit card activity. The bottom line is, just because you may be able to pay a loan with a credit card, it doesn’t mean you should.

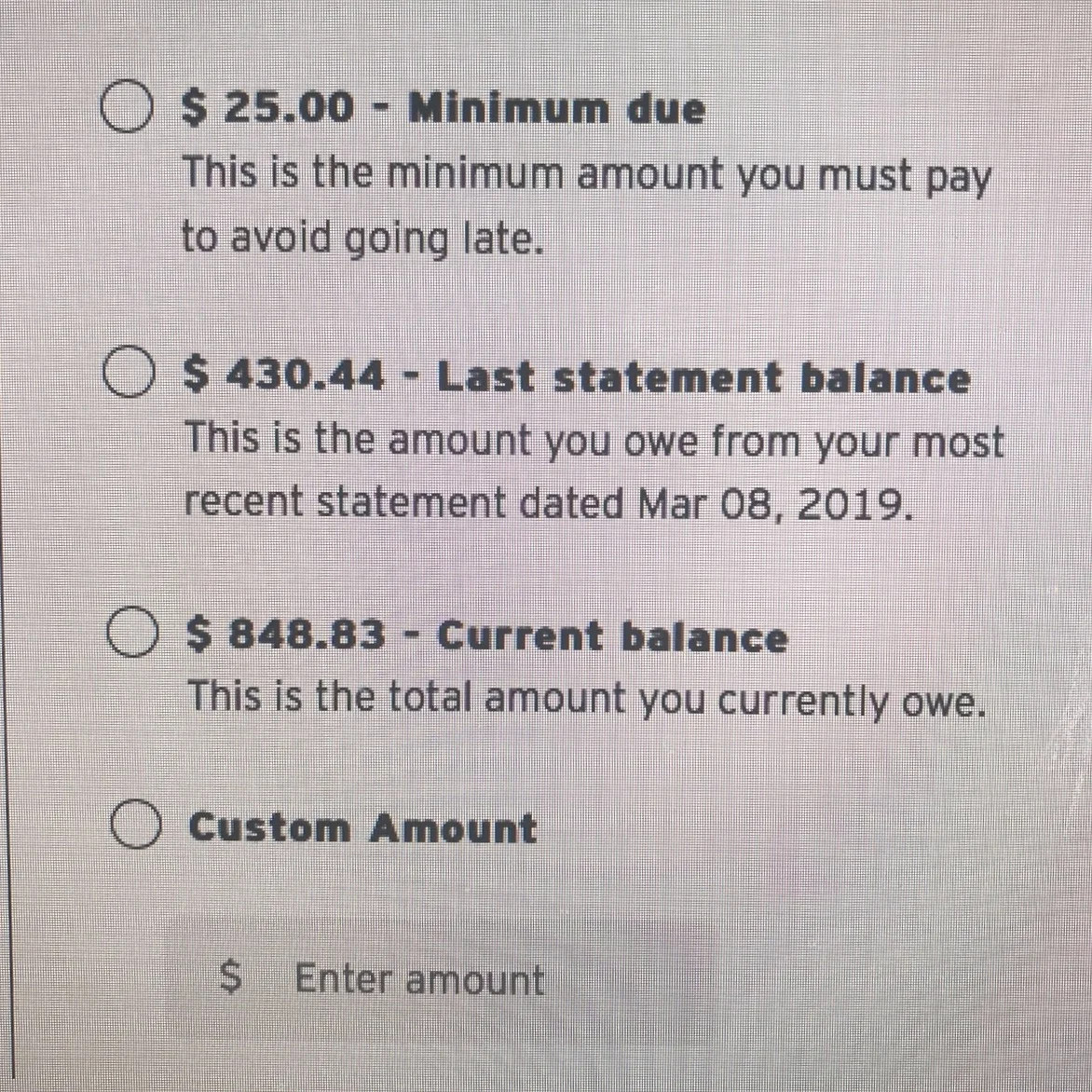

To avoid credit card interest, you need to pay down your balance. Always know how much money you have to ensure you can cover your credit card payments. Therefore, the next important step to take to improve your.

Credit utilization is the next largest factor, making up 30% of your overall credit score. Use your credit card responsibly. Analyse all your credit card payments and avoid unnecessary emis or partial refunds, as this will benefit you in the long run.

If you notice your paying account is insufficient to cover your credit card. Ways to pay a line of credit with a credit card. 9 hours agokeep credit utilization low.

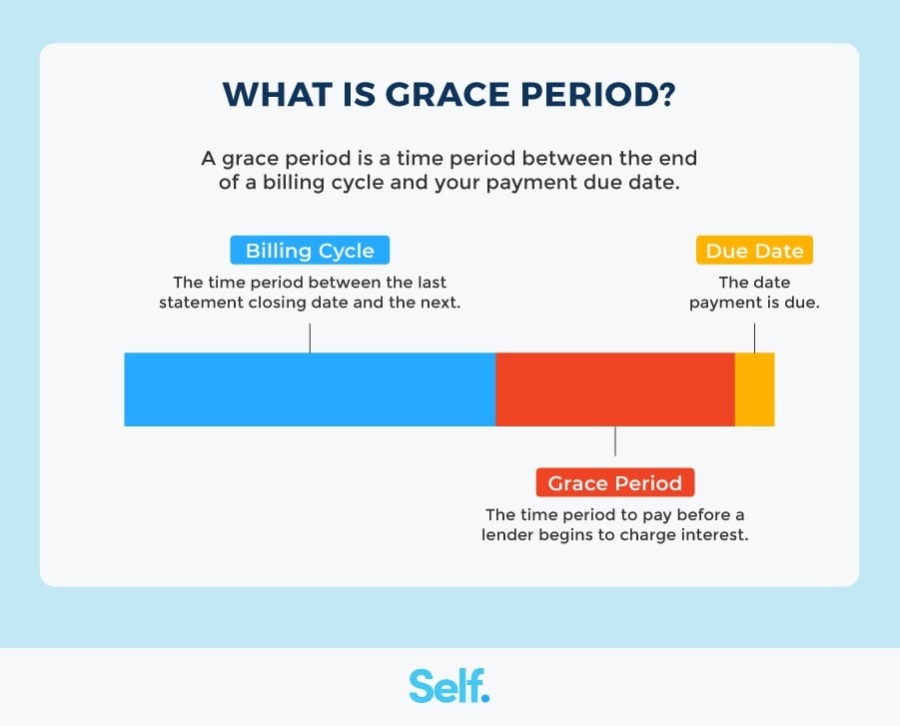

Then you can take the following steps to set up your checking account information and make a payment: This will further lead to more interest charges,. To avoid losing your grace period and paying interest, pay your statement balance in full, on time each month.

As such, you need to keep your balances as small and manageable as possible. Starting with a zero balance each month completely eliminates the risk of getting into credit. To do this, pay the minimum balance on all of your cards except for the one with the highest interest rate.